Blog

Don’t sit on your data – make more of it through smart cooperation

16rd of September 2025

Impact data about realised climate impacts, for example indicating property damage, crop losses, wildfires, or hospital admissions, is crucial for developing climate insurances. However, the availability of impact data is a problem, even though sharing the data has many benefits for both insurance suppliers and customers. Policy actions are needed to promote data sharing to ensure development of insurance innovations that promote climate adaptation.

In the past 15 years large amounts of climate data have been made available for public and private sector users and citizens to support climate adaptation planning. This has been realized via European scale services such as Copernicus Climate Data Store (CDS) and Climate-ADAPT, while also national, regional and thematic or sectoral climate data services have been created (see examples below). The types of data widely available include: 1) georeferenced observations of meteorological variables, such as temperature, precipitation, wind speed, solar radiation, 2) variables derived from meteorological data, such as soil moisture and thermal comfort, 3) hydrological variables, such as river discharges and coastal and inland water levels, 4) derived data on meteorological and hydrological extremes, and 5) joint distributions of the variables mentioned above.

The above-described data provide information on hazardous weather and climate conditions. Thanks to the inclusion of derived data, a first step in the direction of impact data is made. The derived data give information on damage proneness of a certain area in a certain period, but do not inform on the impacts of interest, such as crop yield, hospital admissions, and property value. An exception is data on flood depth, which – if at high spatial resolution – can be matched with building stock data and thereby inform about levels of physical damage and associated direct cost of repair, evacuation, and interrupted production.

Impact data is essential for developing climate insurances

Risk sharing through insurance products constitutes an essential complement to physical and regulatory climate adaptation measures. One could take a very broad perspective and include health care insurances and pensions next to indemnity insurance. In PIISA, we focus on improvement options of indemnity insurances, which pay out to policy holders, when they suffer material damage or losses of their property and associated productivity loss. In addition, parametric and community insurances are explored, as these may offer more efficient incentives to reduce climate related cropping damage.

Indemnity insurance products should be adapted or even redesigned to become climate aware insurances, which incite insured customers to take sufficient preventive action aimed at neutralizing the climate change driven increase of damage risk. This creates a need for new data with which the weather and climate related (extra) damage risk can be analysed. In particular, impact data at sufficiently high temporal and spatial resolution are needed. The data should also be easily combinable with weather and climate observation data, as well as with other relevant data, among others regarding vulnerability of property and population.

Deficient availability of impact data slows down insurance development

Currently impact data at meaningful detail, for example indicating property damage, crop losses, wildfires, or hospital admissions, is deficient and scattered over different sources. The measurement, representation, and quality assurance of impact data are not sufficiently standardized, and a significant share of impact data is not publicly available, be it free of charge or against a charge.

Especially at higher spatial resolutions, data protection legislation may limit the use of impact data. Insurance companies do have impact data, but in many cases these may not suffice for the required risk analysis, for example due to lack of volume or diversity. The vulnerability context of an area may also have changed due to public adaptation measures, for example regarding flood risks.

In the first place, impact data refer here to observed (realized) impacts. In addition, once relations between impacts and hazard intensity and vulnerability context are understood, it is important to have coherent projections of expected impacts for different climate and vulnerability scenarios. Such projections shed further light on the relative contribution of insurance as compared to physical and regulatory adaptation measures.

Based on a literature review and a project internal mini-survey among experts in the PIISA project, the problem of impact data availability was identified as a critical factor with regard to enabling insurance companies to develop climate aware insurance innovations, and to inform potential insurance takers about insurance options alongside prevention measures.

The reasons for impact data deficiency can be divided in two main categories, being (1) the impacts are not or very poorly registered, and (2) the holders of impact data do not allow the use of these data (at meaningful detail) by third parties. In recent decades, lack of impact registration tends to have worsened due to privatisation of infrastructure and changed views on the role of the public sector in the management of natural hazard risks. In quite some cases the registration of impacts either has ceased or is regarded as a task of the involved private companies, from insurance or other sectors.

Policy changes are needed to ensure data sharing

Data driven analysis is essential for insurance innovation. With a growing diversity of data sources, protection needs and responsibilities, as well as risk approaches, it seems indispensable to nurture cooperation between actors in data sharing. Data sharing can, among others:

- enhance and speed up learning in the sector (which tends to reduce the cost of insurance product development)

- promote awareness raising among insurance suppliers and customers (larger demand can improve economies of scale or scope for climate aware insurance portfolios)

- help to optimize the balance between risk sharing measures (insurance), and risk mitigation measures (physical and regulatory adaptation)

As information advantages constitute a key factor for competitive insurance offering, insurance companies tend to be very reluctant in sharing information. Similarly, large property owners and infrastructure companies have reasons to be very cautious with data sharing. On the other hand, public actors often lack the resources to lead public-private data sharing initiatives and/or instruments to incite private actors to join. At the same time, these actors have to cope with broader developments in information services based on big data, aiming at e.g. Insurtech-applications and smart-city services. These technological and market innovations can be enablers for data integration, but many actors want to avoid the risks of being first-mover.

This calls for public policy initiatives that promote and to some extent mandate multi-actor quality assured data sharing aimed at integrated impact, hazard, and vulnerability data, while offering rewards for first movers and early adopters, for example by auctioning innovation and demonstration support funding. Such policies probably entail legislation on – conditional – rights to risk data for the purpose of resilience management. Also empowerment of vulnerable actors (citizens, small firms and municipalities) through user-friendly tools and advice remains important for ensuring fair climate policies. Another, complementary, route could be to mandate regional or national authorities to systematically collect and validate impact data with respect to natural hazards. Similar to various environmental policy areas, such as energy saving, a European observatory for impact data could be created, possibly through an extension of the current risk data hub of the Disaster Risk Management Knowledge Centre (DRMKC) of the EU Joint Research Centre.

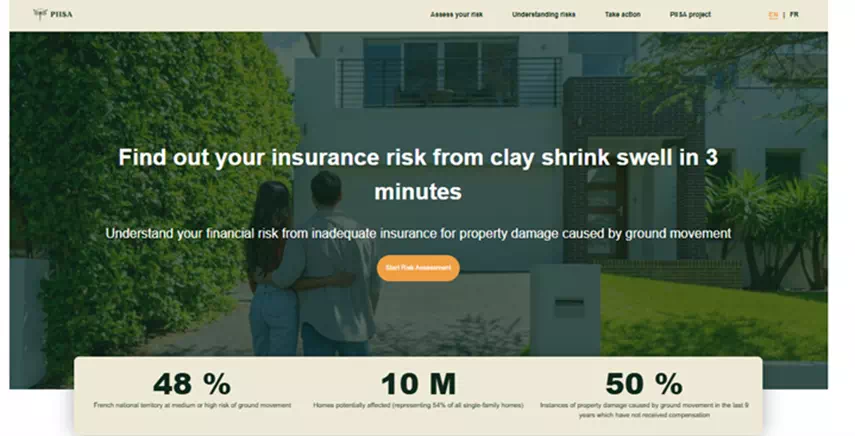

The PIISA project is providing data sets to the DRMKC risk data hub. In one of the pilots a risk assessment tool is developed aimed at empowering citizens to review climate risks of their property in conjunction with possible follow-up action. Also, tools and inventories that should help insurance companies and adaptation actors in search for appropriate risk data, as well as insurance applicability prospects are developed, such as market reviews, including specific ones for agriculture in Finland as well as in Italy and Spain. Furthermore, through the pilots PIISA also aims to engender more lasting initiatives for integrated risk data in conjunction with exploring alternative adaptation solutions (like other crops and green roofs), with special reference to incentivizing effects of insurance innovations.

List of selected national and thematic climate services

- https://www.climateimpactsonline.com/ger/index_de.html?language_id=de

- https://www.klimaateffectatlas.nl/nl/

- http://www.adaptecca.es/

- https://www.ilmasto-opas.fi/etusivu

- https://www.capa-eusalp.eu/home

- https://water.europa.eu/freshwater

- http://www.eswd.eu/

- https://drmkc.jrc.ec.europa.eu/risk-data-hub/#/

Authors

- Adriaan Perrels, Tyrsky Consulting